In this great big world of digitisation seemingly on steroids, and innovations springing up faster than mushrooms overnight after a good soft rain, it is more than easy to be considered out of fashion and outside of the spectrum of useful and technological applications.

Yet somehow, Unstructured Supplementary Service Data remains indispensable as it continues to be utilised alongside recent technology. With a name a tad bit too complex to commit to memory, they have come to be known under the more widespread regionally popular term, USSD!

In Africa, the technology retains a substantial amount of popularity and a high degree of utility within the continent. Across the pond, USSD, more widely referred to as short codes, is much less popular.

The world and the world of technology are constantly on a path of making everything digital; of course, all for improved efficiency and ultimately the betterment of the human race. But sometimes, just sometimes, going back to the things of old may be moving forward into something new. Especially when our part of the world is not moving at the same pace.

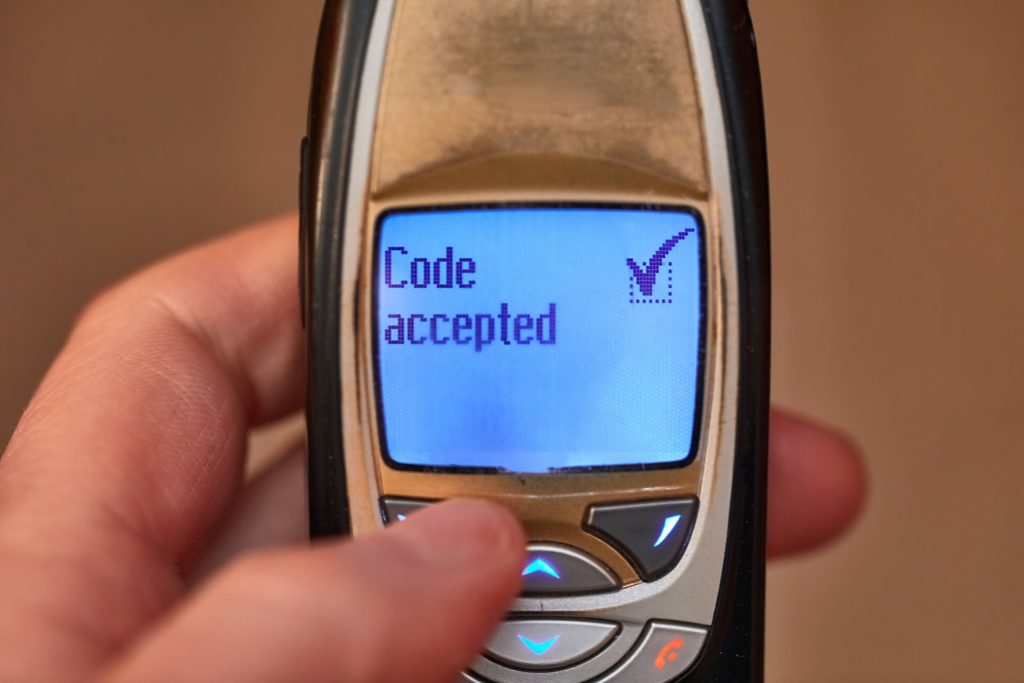

Every time you use the keypad of your cell phone and you input a command that begins with a star (*), usually followed by a series of digits, e.g. 920, and then concluded with an octothorpe, or the hash, or pound (#), you have just performed a USSD interaction! Collectively, it should all look something like this: *920#.

USSD has very fundamental applications that include functions such as ascertaining the balance or remainder of the minutes on your GSM cell phone.

Cellfind, as a proper authority on this subject, defines some of those (basic) functionalities in the following way:

“…This text-driven technology allows users to interact directly from their cell phones by making a selection from a menu. Unlike SMS, USSD operates in real-time. This means it allows for two-way communication of information for as long as the communication line stays open. This makes queries and answers virtually instantaneous…USSD most commonly involves a query generated by a cell phone user (such as a balance enquiry). Once this request is sent, the USSD gateway forwards it to your USSD application. The application then responds to the request, and the process is repeated in reverse: the response goes back to the USSD gateway, which displays the content of that response on your phone screen. Responses are usually sent in an easily displayed format, containing a maximum of 182 alphanumeric characters. Messages sent over USSD are not defined by any universal standardisation, so each operator is free to use a format most suited to its customers.” (van Straten, 2018).

The examples above are presented in the somewhat raw form of the things that USSD can do and has achieved – we can bravely say it gained a good amount of popularity for its functionality and usability. An estimated 94 per cent of financial transactions are performed using USSD.

To that end, a truly worthy mention would be concerning the rocket-fact escalation and expansion of financial transactions in Ghana via USSD technology. The technology allowed for the roping in or otherwise, the financial inclusion of approximately 7.3 million out of some 30 million (as of 2018) Ghanaians who are unbanked and predominantly residing in rural or low-income communities.

CIPESA further illustrates this case of reaching the unbanked through the use of this technology in the following summary:

“Ghana is among the countries leading the drive to expand financial inclusion by leveraging digital solutions. Mobile penetration is 67% and internet access via mobile is 45%. The Bank of Ghana estimates that approximately 7.3 million of Ghana’s adult population is unbanked. As of 2018, there were 32 million registered mobile money accounts across the country’s three leading mobile money operators. These mobile money accounts are generally used for person-to-person and person-to-business transactions. Account holders can access savings, credit, investment products as well as make payments for goods and services via mobile phone” (Financial Inclusion in Africa in an Era of Internet Shutdowns, 2019).

On the topic of transactions, or more specifically, financial and digital transactions, the use of Blockchain technology has been on the rise in recent years. You might imagine or surmise that this spurge of innovation nearly immediately means that technologies of old such as USSD technology would be rendered redundant and quite curtly, dead!

The plague of COVID-19 and the immediate need to send money to severely marginalised communities of a low-income nature (such as migrant settings, refugee camps, and other places of asylum) also arose. All at once, it became apparent that two persistent issues might stay and thwart that effort.

Issue number one, low-income and impoverished communities hardly have access to the kinds of devices, internet, and electricity to reasonably access, learn, and practically use fancy technology payment systems.

Issue number two, the bulk of the people (consisting of people living below minimum wage, refugees, migrants, and other Persons of Concern) did not even have bank accounts to begin with, which means that even on the off chance that money was sent to them via the application of modern technology, how would they use it? How would they make it real by cashing it out?

The answer: they would not be able to. It would remain numbers on a screen or in an account, essentially as useless to them as a car battery with no car – innovative but sorely ill-timed!

It appeared as though the one way to get the much-needed cash during the height of COVID-19, was to do it through mobile money. Mobile Money, also known as MoMo, has an exceedingly high user base in Ghana (approximately 40.9 million registered users).

According to The Conversation, mobile money in Ghana as achieve the following:

“A study by the World Bank indicates that mobile money services have a positive impact on poverty reduction. Poverty is not just about lack of money, but also about lack of access to formal financial systems. Mobile money services can enhance financial inclusion by providing access to savings, credit and insurance services.

In Ghana, mobile money services are provided by telecommunications companies like MTN Ghana, Vodafone and AirtelTigo. The Bank of Ghana reports that the cheques cleared for mobile money transactions amounted to US$2.82 Billion for January 2021. The Bank of Ghana also reports that in 2021, there were 40.9 million registered mobile money accounts and 17.5 million active accounts” (Twum et al., 2022).

The facts are that Africa now accounts for 70% of the world’s $1 trillion mobile money value. The value of Africa’s mobile money transactions edged up 39% to $701.4 billion in 2021 from $495 billion in 2020, highlighting the future of African banking is mobile.

GSMA’s figures released on Apr. 21, show the volume of mobile money transactions jumped 23% to 36.7 billion in 2021 from 27.5 billion in 2020.

In the review period, registered mobile wallets in Africa topped 621 million, a 17% increase from the 562 million captured in 2020.

There are now over 184 million active mobile money wallets on the continent compared to 161 million accounts just over a year before (Onyango, 2022).

As much as the future is mobile, I shall reiterate that for millions of Africans, mobile money means USSD.

One thing we overlook is ways in which technologies, new and old, can safely consult with each other to create innovations and solve real problems for real people during and after hard times.

A worthy example of this working in real life occurred in 2020 during COVID-19 when refugees, migrants, and people living below minimum wage needed cash to stay alive and support. In the end, money that was available from many organisations was sent to the mobile money accounts of the aforementioned people who needed this to survive. Users had only to dial a short code and immediately had equal access to real cash. Quick, effective, user friendly.

This is why I am betting on USSD.

♕ —- ♕ —- ♕ —- ♕ —- ♕

References

van Straten, C. (2018, June 14). What Is USSD, And What Can It Do For Your Business? Cellfind. https://www.cellfind.net.za/what-is-ussd-and-what-can-it-do-for-your-business/

Financial Inclusion in Africa in an Era of Internet Shutdowns. (2019, November 10). Financial Inclusion in Africa in an Era of Internet Shutdowns. https://cipesa.org/2019/11/financial-inclusion-in-africa-in-an-era-of-internet-shutdowns/

Twum, K. K., Gabrah, A. Y. B., Assabil, E. N., Kosiba, J. P. B., & Hinson, R. E. (2022, January 31). Mobile money service quality: what’s important to customers in Ghana. The Conversation. https://theconversation.com/mobile-money-service-quality-whats-important-to-customers-in-ghana-175663

Onyango, S. (2022, May 4). GSMA: 70% of the world’s $1 trillion mobile money market is in Africa. Quartz. https://qz.com/africa/2161960/gsma-70-percent-of-the-worlds-1-trillion-mobile-money-market-is-in-africa/

Financial inclusion: integrating and empowering refugees. (2022, May 20). World Economic Forum. https://www.weforum.org/agenda/2021/08/financial-inclusion-key-integrating-refugees/

♕ —- ♕ —- ♕ —- ♕ —- ♕

I hope you found this article insightful and enjoyable. Subscribe to the ‘Entrepreneur In You’ newsletter here: https://lnkd.in/d-hgCVPy.

I wish you a highly productive and successful week ahead!

♕ —- ♕ —- ♕ —- ♕ —- ♕

Disclaimer: The views, thoughts, and opinions expressed in this article are solely those of the author, Dr. Maxwell Ampong, and do not necessarily reflect the official policy, position, or beliefs of Maxwell Investments Group or any of its affiliates. Any references to policy or regulation reflect the author’s interpretation and are not intended to represent the formal stance of Maxwell Investments Group. This content is provided for informational purposes only and does not constitute legal, financial, or investment advice. Readers should seek independent advice before making any decisions based on this material. Maxwell Investments Group assumes no responsibility or liability for any errors or omissions in the content or for any actions taken based on the information provided.